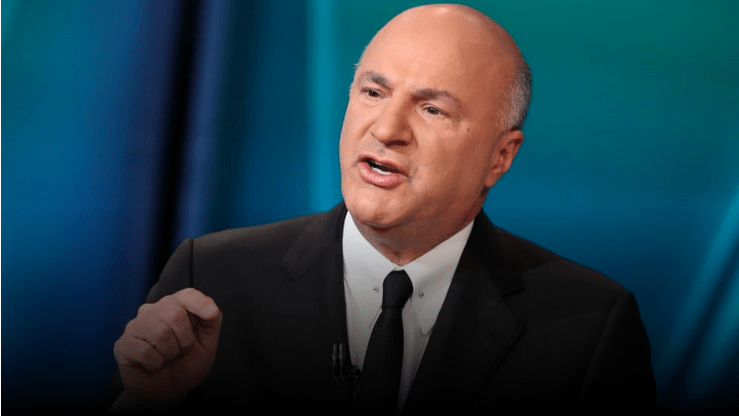

‘Shark Tank’ investor Kevin O’Leary gives advice on when it’s time to close your business and call it quits at CNBC’s Small Business Playbook virtual summit on Wednesday.

Consumer behaviors have shifted and now may be the time to pivot your business in the digital economy, he said.

Never use more than one-third of your company’s free cash flow to service debt or you will never be able to reinvest and grow your business.

Investor Kevin O’Leary believes in tough love, especially now when entrepreneurs on Main Street are trying to figure out whether it’s time to hang onto their business — or shut down.

“This is the time to stay focused and positive,” O’Leary said, speaking at CNBC’s Small Business Playbook virtual summit on Wednesday. “Entrepreneurs are creative by nature and many will live to see another day through this [pandemic]; but others will not. You’ll know in your heart when it just isn’t going to work out.”

He should know. O’Leary started his first business out of his basement in 1986. In 1999, O’Leary and his co-founders sold the company to the Mattel Toy Company for $4.2 billion. He has had several hits since. In addition to investing in successful companies via ABC’s “Shark Tank,” O’Leary founded businesses including O’Shares ETFs, O’Leary Financial Group and O’Leary Wines.

Along with success, O’Leary has also had his share of failures, and that offers an important lesson for entrepreneurs. “Sometimes it just makes more sense to start fresh when you have more certainty about market conditions,” he says. “There is no shame in shutting down a business if you think it’s no longer viable.”

He notes many successful entrepreneurs failed two or three times before launching a venture that works for them. On a personal note, O’Leary projects that 20% of his small private portfolio companies will fail because they haven’t been able to reinvent their business models during the pandemic.

“Remember, you only need one hit to set yourself free in life. This may be the time to pivot and pursue something new in the digital America 2.0 economy right now,” he explained. “Consumer behaviors have shifted. It’s all about selling products or services directly to consumers who have gotten used to this method of shopping since the Covid-19 health crisis began. It’s a whole new generation of people who are planning not to go to stores anymore.”

It’s a brand new world

This is a fundamental shift and it is changing the way business works, O’Leary notes. There are some industries, such as travel, entertainment and weddings, that are permanently damaged until a therapeutic or vaccine is available.

O’Leary’s comments came as policymakers in Washington, D.C., debate another piece of coronavirus relief legislation. The Paycheck Protection Program under the CARES Act expired last Saturday for businesses who have not yet applied for a loan. Lawmakers have yet to reach any agreement over a new aid package for Americans, including new loan programs and second-draw PPP loans for businesses in need. President Trump’s executive orders signed over the weekend, which include unemployment assistance, a payroll tax hiatus, student loan relief and eviction protection, do not cover small business.

“It’s a brand new world,” O’Leary said. “The key is to communicate and forge a direct relationship with your customers. You need to reach out to them and explain the benefit of your product and services. Above all, let them know you are still in business, even if your physical store has closed.”

Shopify and Facebook offer a platform and other tools that can help you make that digital pivot, he said.

There is a big value proposition with a digital model since you can save a lot on operating costs including rent and distribution, but you need to assess another key factor. “Ask yourself, ‘What is my customer acquisition cost?’ and ‘What is the lifetime value of my customer?’ If it costs you $20 to acquire a customer, and you only profit $10 from each customer, you’re going to go bankrupt. This is the simple model everyone should be looking at,” he said.

As O’Leary explains, you must get your customer acquisition costs below their lifetime value (future net profit from the relationship), or your business will never make enough money to survive. You’ll blow it all on advertising.

Keep in mind, taking on debt when your business is in trouble is not always a good idea, O’Leary cautions. If you have no income or revenue I do not recommend taking on debt at this time. “Use this simple formula: Never use more than one-third of your company’s free cash flow to service debt. And that includes the principal and interest payments. That’s the magic number.”

According to the small business expert, the minute you go beyond that amount, you put tremendous pressure on your company. “Servicing debt doesn’t allow you to reinvest in the business. It doesn’t allow you to have any free cash flow to acquire new customers. It doesn’t allow you to grow,” O’Leary said. “It becomes a barbell of weight on you, and that’s very stressful. Sometimes it makes more sense to just let it go.”